New Gaap Revenue Recognition Rules 2024

New Gaap Revenue Recognition Rules 2024. 2024 gaap financial reporting taxonomy; Skip to the beginning of the images gallery.

It covers the new authoritative literature related to revenue recognition that became effective in the past few years. In this publication, we’ve summarized the new accounting standards with mandatory 1 effective dates in the first quarter of 2023 for public entities, as well as new standards.

The New Standards Fundamentally Alter The Approach To Recognizing Revenue Under U.s.

Both accountants and readers of.

Fasb Released Its Three Annual Taxonomies:

The revenue recognition and lease changes will require increased disclosures in your financial statements from previous years;

However, Previous Revenue Recognition Guidance Differs In Generally Accepted Accounting Principles (Gaap) And International Financial Reporting Standards (Ifrs)—And Many.

Images References :

Source: www.financialfalconet.com

Source: www.financialfalconet.com

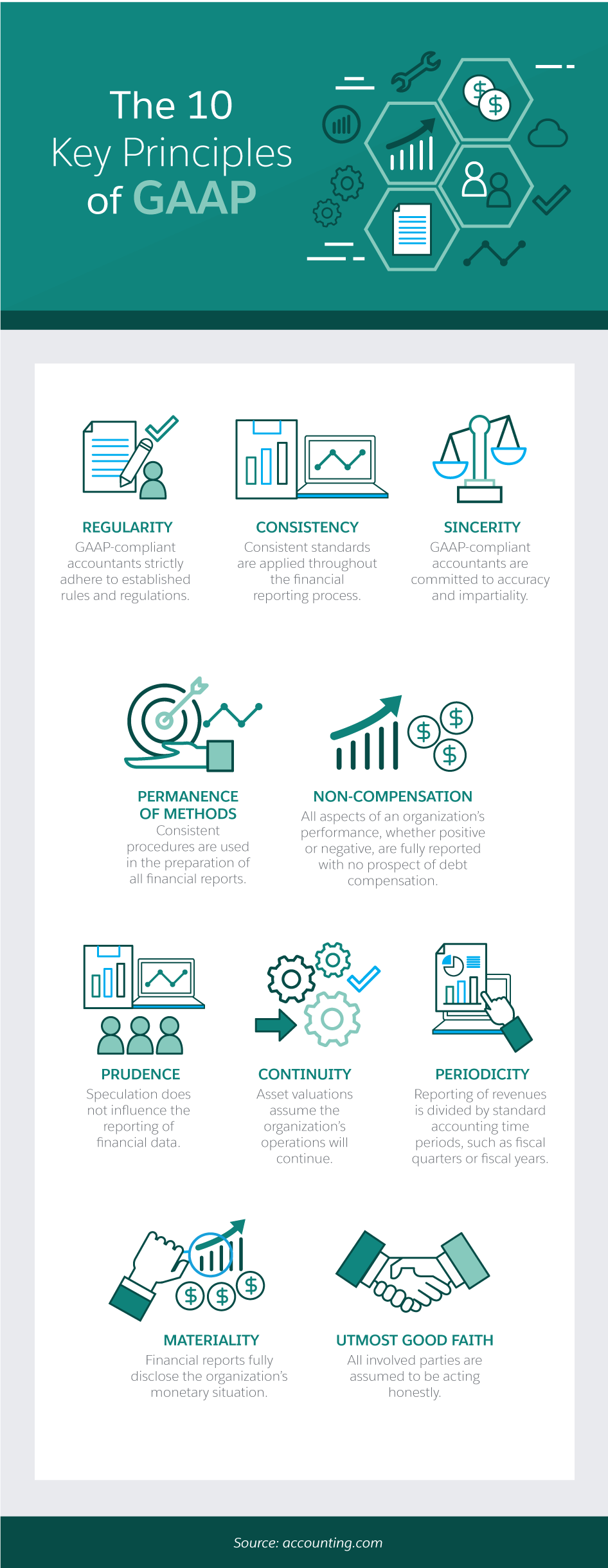

GAAP for Revenue Recognition Criteria and Examples Financial, Skip to the beginning of the images gallery. Generally accepted accounting principles (“gaap”).

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

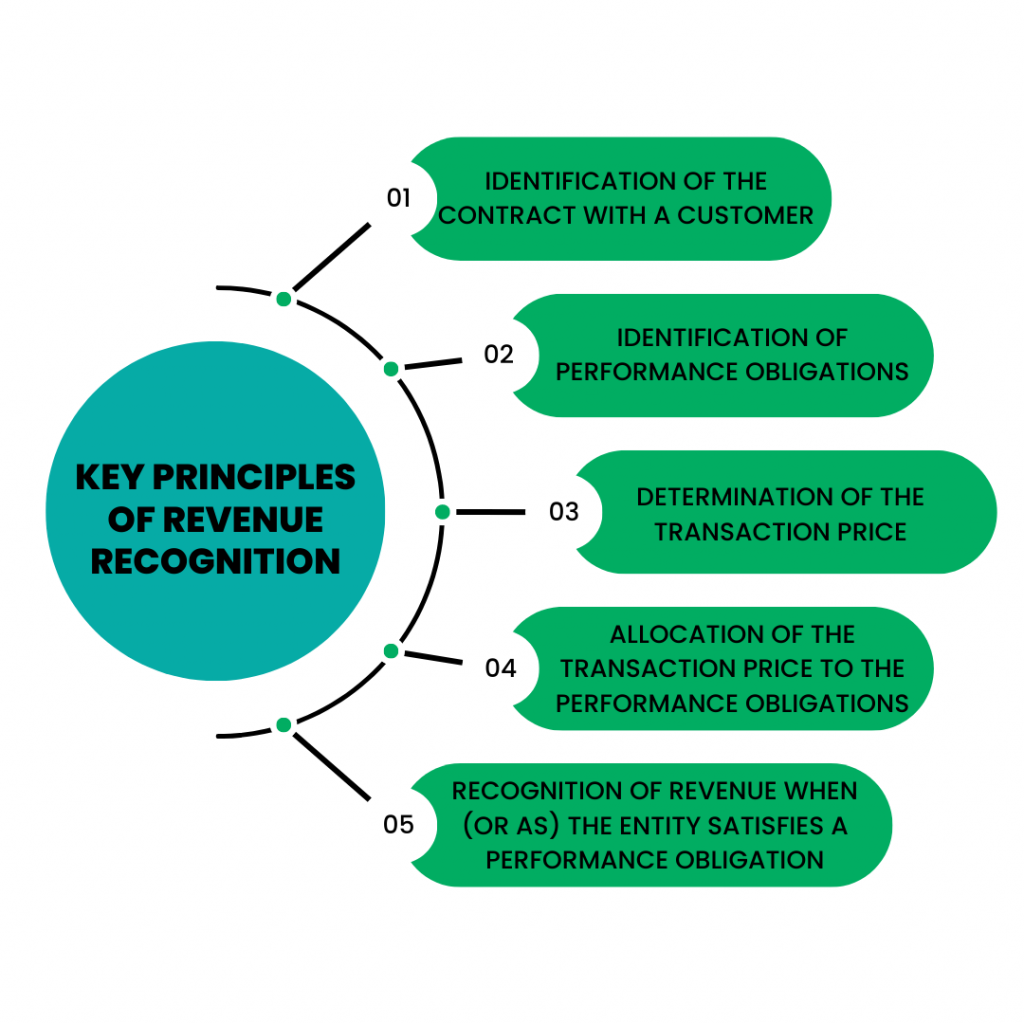

Revenue Recognition Principles, Criteria for Recognizing Revenues, The 2024 gaap financial reporting taxonomy (grt) contains updates for accounting standards and other improvements since the. “so it is important to record revenue correctly and consistently.” smart business spoke with wilson about the changes to revenue recognition standards and what companies should.

Source: blog.bi101.com

Source: blog.bi101.com

Help sales understand revenue recognition rules and avoid problems, The public comment period on the proposed updates will end on march 18, 2024. In this publication, we’ve summarized the new accounting standards with mandatory 1 effective dates in the first quarter of 2023 for public entities, as well as new standards.

Source: www.gotransverse.com

Source: www.gotransverse.com

Revenue Recognition and ASC 606 A Primer Gotransverse, Fasb released its three annual taxonomies: Wolters kluwer's gaap guide® is the most.

Source: warrenaverett.com

Source: warrenaverett.com

The New Revenue Recognition Model Revenue Contracts with Customers, The revenue recognition and lease changes will require increased disclosures in your financial statements from previous years; Why did the fasb issue a new standard on revenue recognition?

Source: www.salesforce.com

Source: www.salesforce.com

Revenue Recognition Principle Definition & Methods, The new standards fundamentally alter the approach to recognizing revenue under u.s. To help you stay on track, we’ve compiled a short list of new gaap accounting standards that are effective now (or can be early adopted), so you can make sure you’re.

Source: synder.com

Source: synder.com

Revenue Recognition Key Principles Of The Backbone of Accurate Financial Reporting, Revenue recognition guide clarifies revenue recognition concepts. The fasb has announced the availability of the 2024 gaap financial reporting taxonomy, the 2024 sec reporting taxonomy, and the 2024 data quality committee (dqc) rules.

Source: www.youtube.com

Source: www.youtube.com

GAAP Chats Step 4 of New Revenue Recognition Standard YouTube, The revenue recognition and lease changes will require increased disclosures in your financial statements from previous years; Paragraph 30 of ias 8 requires an entity to disclose if there are new accounting standards that are issued but not yet effective, and information relevant to assessing the possible.

Source: www.gaapdynamics.com

Source: www.gaapdynamics.com

Revenue Recognition GAAP Dynamics, The past several years have been a whirlwind of change in the accounting industry. In this publication, we’ve summarized the new accounting standards with mandatory 1 effective dates in the first quarter of 2023 for public entities, as well as new standards.

Source: www.johnsonlambert.com

Source: www.johnsonlambert.com

Applying the New GAAP Revenue Recognition Standard to Insurance Organizations Johnson Lambert, Revenue is one of the most important measures used by investors in assessing a. Shop the cch® ebook version of this title for instant access, anytime, anywhere.

Revenue Recognition Guide Clarifies Revenue Recognition Concepts.

June 26, 2024 | join this dbriefs to be able to demonstrate a new understanding of these and other important accounting issues and developments for the quarter.

Step 5 Uses A Single Approach Instead Of The Current Distinction To Consider When Significant Risks And Rewards Of Ownership Are Transferred For Goods, And The Stage Of Completion For.

2024 gaap financial reporting taxonomy;